what is the inheritance tax rate in virginia

No estate tax or inheritance tax. Property owned jointly between spouses is exempt from inheritance tax.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40.

. The estate tax is a tax on a persons assets after death. The tax is assessed at the rate of 10 cents per 100 on estates valued at. 45 percent on transfers to direct descendants and lineal heirs.

The top estate tax rate is 16 percent exemption threshold. No estate tax or inheritance tax washington. No estate tax or inheritance tax.

This fact often becomes an unpleasant surprise for heirs. The top estate tax rate is 20 percent exemption threshold. How much is federal tax on inheritance.

The top rate is 40. When the inherited assets exceed your lifetime exemption of 1206 million. Decedent means a deceased person.

Localities may also impose a local probate tax equal to 13 of the state probate tax. Here is an example. How is personal property tax calculated on a car in virginia.

The tax is assessed at the rate of 10 cents per 100 on estates valued at more than 15000 including the first 15000 of assets. In the letter case the inheritance becomes subject to federal estate taxation with a progressive scale that varies from 18 to 40. For example the tax on an estate valued at 15500 is 1550.

Taking into account the 1206 million exemption the taxable estate is 5 million putting this estate in the top tax bracket. The estate tax was imposed on the transfer of a taxable estate at a rate equal to the maximum amount of the federal credit for state estate taxes as it existed on January 1 1978. How much can you inherit without paying taxes in Virginia.

Currently the Lottery is required to withhold 24 for federal taxes and 4 for state taxes. Although the inheritance tax was repealed it continued to apply to remainder interests on. The base payment on the first 1 million is 345800 and 40 is owed on the remaining 4 million.

If you win more than 600 it will be reported to federal and state tax agencies. 56 million West Virginia. The estate tax is a tax on a persons assets after death.

This chapter shall be known and may be cited as the Virginia Estate Tax Act Code 1950 58-2381. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. The estate tax rate is 40 so you should do everything in your power to minimize any estate tax exposure.

Price at Jenkins Fenstermaker PLLC by calling 866 617-4736 or by completing our firms Contact form. 15 percent on transfers to other heirs except charitable organizations exempt institutions and government entities exempt from tax. This is great news for Virginia residents.

2193 million Washington DC District of Columbia. If you win more than 5000 taxes will be withheld automatically. I would be happy to help you manage the tax issues presented by an inheritance.

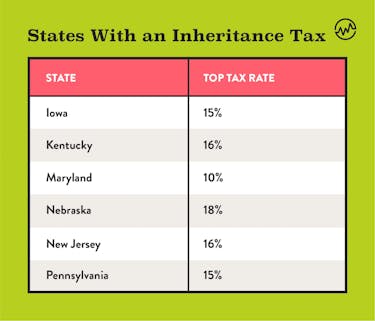

Ad Inheritance and Estate Planning Guidance With Simple Pricing. Inheritance and Estate Tax and Inheritance and Estate Tax Exemption Virginia doesnt have an inheritance or estate tax. Lets say an estate is worth 1706 million.

Virginia taxes capital gains at the same income tax rate up to 575. No estate tax or inheritance tax. If you are considering your estate plan or have recently received an inheritance and need more information contact me Anna M.

As used in this chapter unless the context clearly shows otherwise the term or phrase. But just because Virginia does not have an estate tax does not mean one is not assessed at the federal level. Unlike the federal estate tax where the estate pays the taxes inheritance taxes are the responsibility of the beneficiary of the property.

Code 581-901 and 581-902 as in effect on December 31 2006.

Inheritance Tax Here S Who Pays And In Which States Bankrate

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2020 Estate And Gift Taxes Offit Kurman

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What To Do And Not Do With An Inheritance

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Is Your Inheritance Considered Taxable Income H R Block

States With An Inheritance Tax Recently Updated For 2020 Jrc Insurance Group

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Inheritance Tax Here S Who Pays And In Which States Bankrate

401 K Inheritance Tax Rules Estate Planning

Top Real Estate Company In St Kitts Nevis 2021 Top Real Estate Companies Interior Design And Real Estate Real Estate

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

What To Do When You Inherit A House Complete Guide To Selling Fast

Where Not To Die In 2022 The Greediest Death Tax States